- What's Drippin'

- Posts

- 📈 tZERO's IPO, Propy's Shopping Spree, and Stablecoin Frenzy

📈 tZERO's IPO, Propy's Shopping Spree, and Stablecoin Frenzy

Your Bi-Weekly RWA Breakdown

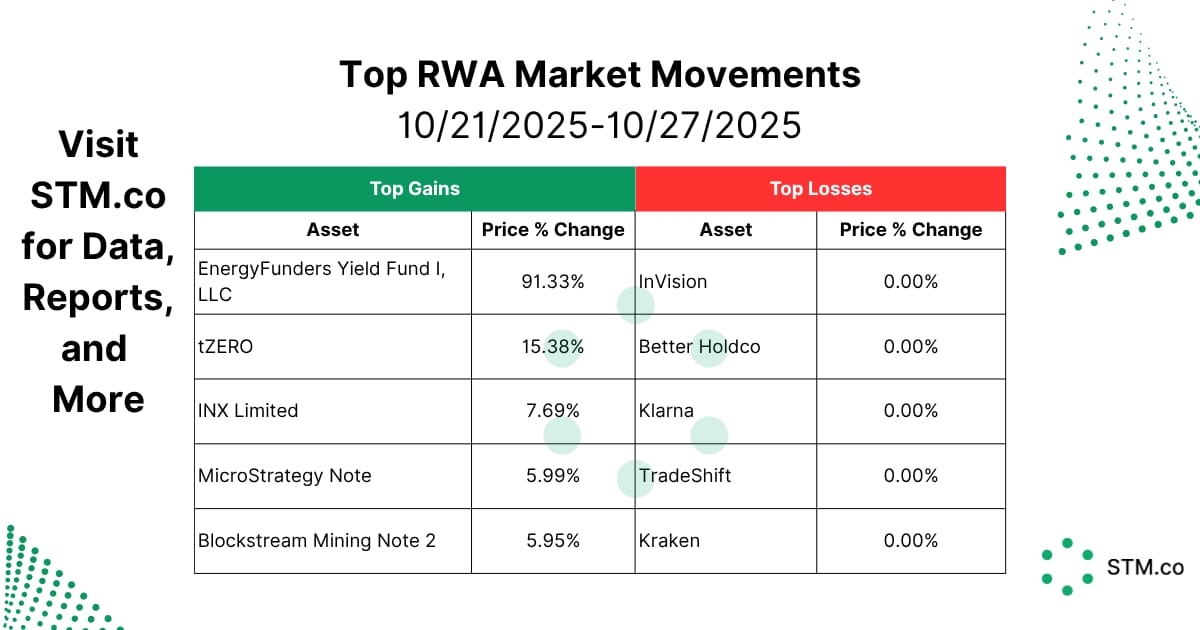

Enjoy a summary of the top headlines, market movements from the data team, special announcements, and Herwig’s thoughts on what’s going on in this fast-evolving space.

Without further ado, it's time to…

Get Liquid 💧

Summary and Key Takeaways

1. tZERO Announces IPO Plans

The major U.S. tokenization ATS’s are all evolving this year! INX? Acquired by Republic. Securitize? Going public via Cantor Fitzgerald's SPAC. Oasis Pro? Acquired by Ondo. As for tZERO, the one with the closest relationship to public markets announced this morning they’ll be IPOing as well! The ICE-backed tokenization platform has been making multiple announcements and partnerships over the last couple of months especially as Alan Konevsky took over, becoming more transparent in their plans. IPOing is more than just a very loud capital raise, it means increased reporting and compliance which as we’ve said before, shouldn’t be a problem for Alan given his previous role as Chief Legal Officer. tZERO is welcoming it with open arms just as they have with being regulated by both the SEC and CFTC with the ultimate goal of servicing as many assets on their platform as possible - securities, crypto, and derivatives alike. Most of the crypto IPOs have been happening on Nasdaq, the exchange that has been publicly pursuing tokenization lately, however tZERO’s large ICE investor owns NYSE. Will they list there or follow the status quo? Will NYSE go loud after the IPO and announce tZERO as their tokenization infrastructure after the IPO? Let’s keep an eye on this development.

2. Propy is Going on a $100M Shopping Spree

Just last week at DigiAssets 2025 Jason was asked onstage about individual properties being tokenized to which Jason shared Propy as an example along with the $240B worth of deeds Bergen County is putting on Avalanche with Balcony. However this raised a question on the lack of scale. The underlying reason? Lack of standardization across registries (even from state to state). Two days later Propy announces they’re going to try fixing it themselves by acquiring multiple mid-sized title companies! Propy isn’t just tokenizing an asset and letting you buy it with bitcoin, they’re combining AI and blockchain to streamline real estate transaction workflows, escrow, and now by rolling up these firms they’ll be implementing them across the board to reach scale (and a target $1B valuation). Where will the funding come from? Aside from the usual, TradFi suspects Propy is going to use Morpho to raise private credit from the masses using a DeFi vault! If Natalia Karayaneva and her team can execute on this, they have a fair shot at redefining title registry and transactions by expanding the “Propy standard” while letting everyday people join in for the journey.

3. Vantage and Custodia Go After Regional Banks for Tokenized Deposits

The stablecoin and tokenized deposits space continues to see a race, from purpose-built L2s to consortiums and regional banks & credit unions in the U.S. are about to get theirs with Vantage and Custodia offering tokenized deposits for them. According to the press release, the token framework could be adjusted based on the need for tokenized deposits vs. stablecoin issuance. The biggest difference? As many know, banks enjoy fractional banking (10% reserves) for tokenized deposits and FDIC insurance on them vs. stablecoins needing to be GENIUS-compliant and fully reserved without FDIC insurance. What are the use cases? Instant, cross-border payments are a big one with one of Vantage’s oldest clients using them to pay truck drivers within an hour of delivery in another country. Automated payment distributions upon hitting milestones is just the beginning but the real advantage for smaller banks that can’t build full digital asset units is to be able to plug into the onchain economy, seamlessly, and offer that service to their customers - keeping them from falling behind operationally while keeping innovative solutions available for their customers. With that said, the consortium is open to any sized bank so it’ll be interesting to see if any super regionals or GSIBs join in and how this impacts their relationships with regional banks and credit unions.

4. Inveniam Announces L2 Blockchain and Diol

Coming fresh from Inveniam’s new Agentic conference in Dubai, they’re working with MANTRA to launch their own L2 blockchain, Inveniam Chain, specifically for private real estate assets. Why do their need their own chain? Likely to customize its integration with their existing platform which houses data about these assets. Linking appraisals and other documents to the asset itself starts powering their Proof of Origin, Proof of State, and Proof of Process which ultimately helps solve the problem of opaque information and its effects on liquidity for private market assets. This isn’t just for tradabilty but also could be repurposed for creating index products (which S&P is getting louder about), AI agents, and more.

They aren’t stopping at enhancing assets, however, as they also announced the acquisition of Storj to create Diol - a data marketplace for data, compute, and storage. If you have a bunch of data related to your assets or that you’ve acquired over time, wouldn’t you want to monetize it? By putting that data on this platform, Diol is enabling people and companies to retain ownership of it while giving permissioned access to it (think of it as a subscription to an API but with all the data onchain). With 26,000 market participants at launch, this platform is hitting the ground running and could very well power the future of finance. That’s a lot of data that could contribute to reports, new investment products, and who knows what else the DeFi world can put together. Should Propy be partnering with Inveniam as they acquire more title companies? Probably.

5. Stablecoin Acquisitions Continue as Market Enters Frenzy

Let’s just appreciate the size and business model of the stablecoin market today. Solely looking at revenue, $300B in stablecoins means there are real dollars held by those companies (for redemption) that are sitting in liquid instruments likely gaining around 4%. That’s a whopping $12 BILLION a year. Banks are no longer monopolizing this business model and crypto companies are coming for their lunch in a big way. Aave Labs acquired Stable Finance to help with its move towards onchain finance. We also saw XDC Network acquire Contour for its stablecoin and tokenization capabilities. That now marks over 10 stablecoin related acquisitions this year.

We expect banks to strike back with deposit tokens but will those be sufficient replacements for how stablecoins are being used and purchased for today? Or maybe it's simply the beginning of the end for paper and digital (non-tokenized) money.

This is not financial advice.

Notable Market Headlines

Don’t Miss Out! Ever wanted to invest in films? Ron Perlman is making a whole platform for it called Watrfall and it’s available to all on Republic via RegCF. It’s only available for 4 more days - Last chance!

10/25 - Ferrari to launch digital token to let fans bid on its Le Mans-winning race car

10/23 - tZERO and Archax Team Up to Expand Global Distribution and Cross-List Digital Assets

10/23 - Akemona Focuses Strategy on Tokenization and AI Flowbook-Powered Digital Exchanges

10/22 - Securitize Unveils MCP Server to Power AI Access to Onchain Assets

10/22 - Tokenization Is Fixing Film Financing, Dethroning Hollywood Studios

10/22 - Inveniam Acquires Storj to Power the Future of Decentralized Data Infrastructure

10/22 - G&M × UniCask: The World’s Oldest Whisky Tokenized — 'Glenlivet 8

10/22 - XDC Network Acquires Contour to Expand Stablecoins and Tokenization in Trade Finance

10/22 - Real Estate Tokenization Firm Propy Eyes $100M U.S. Expansion to Modernize Title Industry

10/20 - Inveniam and Mantra unveil Inveniam Chain: A layer 2 blockchain for private real estate assets

10/20 - CoinLander Launches RWA Platform, Unlocking Stable Returns from Tokenized Real Estate Mortgages

10/20 - Grove integrates with Aave Horizon to supply RLUSD and USDC liquidity

10/20 - NewGenIVF Group Limited Engages in Art Tokenization Partnership with World Chinese Museum Co., Ltd..

10/20 - Ondo brings 100+ tokenized U.S. stocks and ETFs to Blockchain.com users

10/20 - Exodus Announces Common Stock Tokens on Solana with Superstate

Institutional Activity

RWA Foundation & WALLY DAO Updates

The RWA Foundation introduced the RWA Pod as “A permissionless way for anyone to support RWAs using crypto with multiple RWA project tokens as yield.”

In partnership with PERQ, the RWA Pod allows you to deposit ETH, USDC, ARB, and S/ Sonic. Participants will receive tokens on multiple blockchain protocols related to RWA projects that the RWA Foundation has qualified and selected as Founding Members.

Two of the tokens in the POD rewards are Brickken’s BKN and DRVN’s BSTR. Want to learn more about them? Check out interviews with their founders now available on X and on YouTube, go ahead and check them out 👇!

Think Like Herwig

Hello readers,

It’s clear that this time is different. Sure, you’re going to get a lot of fluff and continue POCs and niche partner roll outs from the institutional market. There is still no pressure to mass migrate legacy tech, just hunt out new fees or specific efficiencies to trial.

But what is different is DeFi is now clawing its way into RWAs. Stablecoins and vaults (as I’ve been saying for years now) are finally now actually enabling new permissionless financing and in other cases are creating utility out of RWAs. Look at Aave Horizon’s growth alone. Maple nears to a record $5B in total assets locked up in their products. It’s beautiful to see it coming to life and ensuring that this time, it’s different.

The next 6 months will continue to onboard more institutions and investors, launch new asset backed products, and invite more platforms and licensed venues into the market, some of which will be pushing the boundaries into DeFi.

Happy tokenizing,

Herwig “Happy” Konings

CEO, Security Token Group

💦 What Else is Drippin’

Security Token Show Ends with 300 Episodes!

Check out the latest and final episode of the Security Token Show as well as the full catalog on Youtube, Spotify, Apple Podcasts & Google Podcasts.

Reports

RWA Tokenization: Key Trends and 2025 Market Outlook

Check out a report we contributed to: RWA Tokenization: Key Trends and 2025 Market Outlook. Led by Brickken, this report brings multiple parties together in diving into tokenization, with STM.co supporting with both data and some of the written sections.

What’s Inside?

✅ A Breakdown of Tokenization and Related Benefits

✅ Key advantages for issuers, investors, and institutions

✅ How the market is evolving and trends shaping adoption in 2025

✅ What’s next? Expert insights on regulation, DeFi integration, institutional involvement, and market growth

STM’s RWA Market Prediction for 2030

STM.co is proud to release a thorough report on our prediction on the tokenized real world asset market growth. This report explores the variety of opportunities within each asset class to capture value on-chain.

Tokenization can be applied to just about any object and asset type. Art, carbon credits, life insurance, and other sub $5 trillion asset classes weren’t even considered in estimates.

In order for STM to derive its 2030 market predictions, the following asset classes were evaluated: currency, M2/M3, real estate, commodities, public equities, private companies and funds, bonds, credit and lending markets.

This is not financial or investment advice.

Helpful Resources

$30 Trillion by 2030 - STM

Tokenizing an Asset in 3 Easy Steps - Security Token Show

Tokenization for Institutions - What You Need to Know - STM, Arca (YouTube)

We hope you enjoyed this week's What’s Drippin’ email - if you have any feedback on either what you liked or what you’d like to see, please reply to this email with it.

Everything in this newsletter is for informational and entertainment purposes only. Nothing in this report should be taken as financial advice or as an inducement to purchase or sell any security. Nothing in this newsletter should be used as legal advice. Always do your own research before making any decisions regarding financial transactions of securities.