- What's Drippin'

- Posts

- 🏦 Onchain Lending for Tokenized Stocks and Chainlink's State Scoreboard

🏦 Onchain Lending for Tokenized Stocks and Chainlink's State Scoreboard

🌴 Your Mid-Week Security Token Digest

If this email was forwarded to you, subscribe here to get it directly in your inbox every Wednesday!

Good morning and welcome to your Wednesday security token digest! ☀️

As always, we have two captivating topics for you to dive into:

1️⃣ 🚀 Equity Enters DeFi: xStocks on Kamino Lending Protocol

2️⃣ 🔗 Bridging States & Chains: Chainlink’s "Tokenized in America"

Without further ado, it's time to…

Get Liquid 💧

Your First Captivating Topic of the Week

🚀 Equity Enters DeFi: xStocks on Kamino Lending Protocol

A top Solana lending protocol, Kamino, just unlocked a game-changing feature: you can now use tokenized stocks (xStocks) as collateral to borrow stablecoins. Backed Finance is behind these tokenized versions of Apple, Tesla, and over 60 others, selecting Kamino to become the first major DeFi lender to accept equities onchain.

What’s pumping the rails here?

Onchain equity meets automated credit flows. With Chainlink oracles delivering sub-second price updates and Kamino’s infrastructure supporting real-time borrowing against stocks, there’s no brokers, no sleepless waiting

Real-world assets (RWAs) are going mainstream. Tokenized equities push Solana’s TVL further into TradFi territory, joining tokenized treasuries and private credit in the $65 billion+ RWA boom

Beyond crypto tokens and stablecoins, users can now collateralize RWAs permissionlessly, opening new lending, margin, and treasury uses. While RWAs deepen access, they also carry compliance weight. How Kamino balances user autonomy with regulatory guardrails could set a blueprint for tokenized TradFi at scale along with DeFi-enabled utility.

As DeFi protocols layer in tokenized equities, do we edge closer to a truly permissionless TradFi stack? How will onchain identity get catalyzed from this?

This is not financial advice.

Monday’s Onchain: Weekly X Spaces

Join us on Monday’s Onchain to talk about

📰 Tokenization News

🚀 New RWAs

⭐️ Featured Guests and more!

Set your reminder and see you there!

Your Second Captivating Topic of the Week

🔗 Bridging States & Chains: Chainlink’s "Tokenized in America"

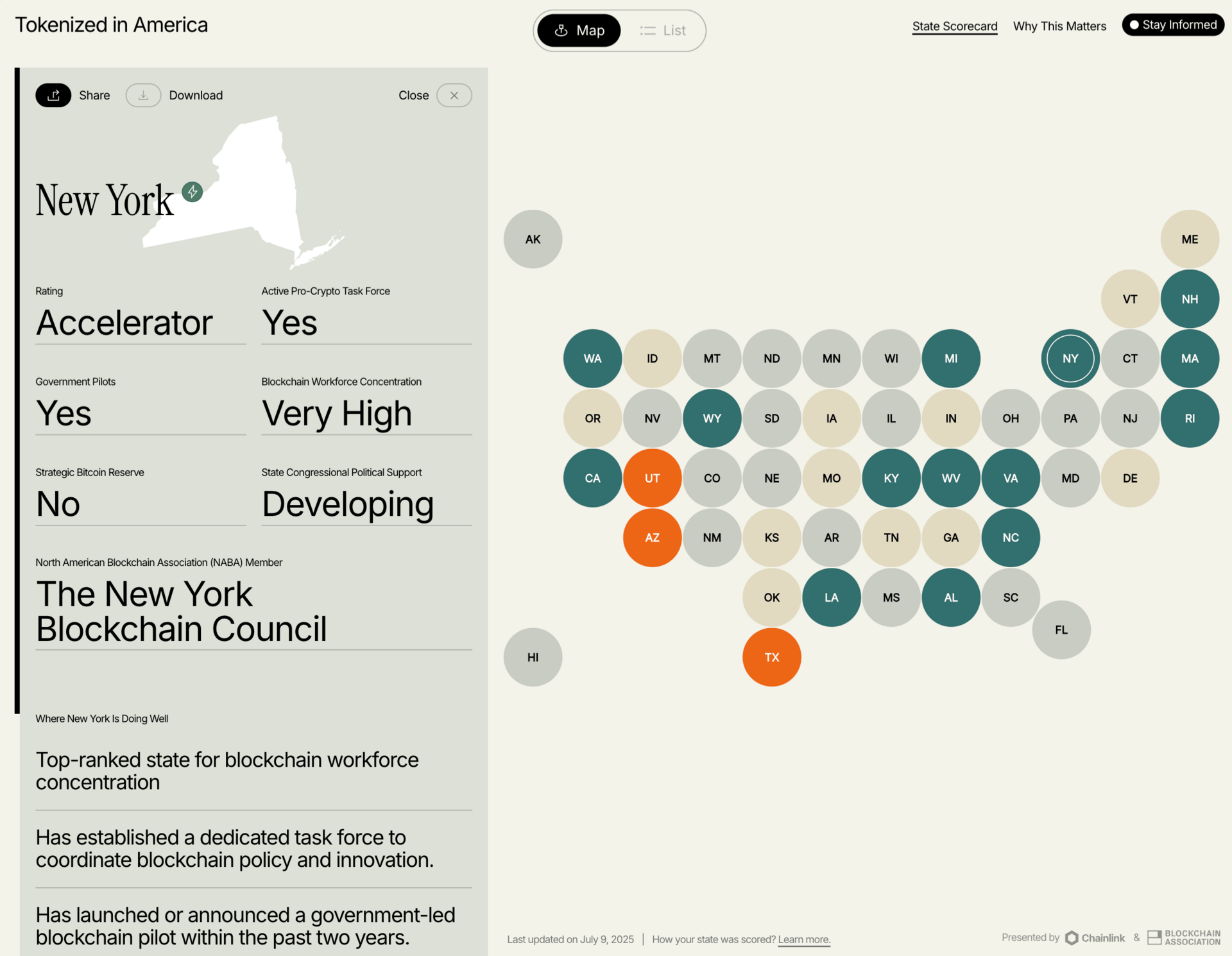

Chainlink Labs and the Blockchain Association just launched “Tokenized in America,” a nationwide scorecard ranking all 50 U.S. states on their readiness to support digital asset innovation, especially real-world asset (RWA) tokenization. Using a six-pillar framework (from legislative support to institutional adoption), the initiative hands out top marks to “Trailblazer” states like Texas, Utah, and Arizona, while highlighting surprising laggards like Florida.

Why this matters:

Tokenization is going local. States are emerging as the real “labs” for RWA adoption, experimenting with stablecoins for payments, crypto treasuries, and asset tokenization pilots. This scorecard doesn’t just rank them, it gives them a playbook.

Oracles meet policy. Chainlink’s deeper bet here is strategic: enabling tokenized assets means making their compliance and provenance data legible onchain. Therefore, this partnership means that if a state government wants to tokenize an asset (like real estate), Chainlink offers real-time data on asset’s valuation, for example. If it’s a stablecoin or deposit token approved at state level, Chainlink could provide Proof of Reserves for them.

From lobbying to standards-setting. Rather than just advocate for crypto, this project begins to define what “good” looks like for tokenization policy which helps pave the road for institutional confidence, interoperable infrastructure, and real capital flows.

Tokenization can scale state by state. But that only works if jurisdictions benchmark, learn, and compete. This isn't a press release, it's a scoreboard. And now everyone can see who’s playing to win.

This is not financial advice.

💦 What else is Drippin’

Companies of the Week

Company of the Week - Herwig: GATES, Inc.

Company of the Week - Kyle: DMZ Finance

Find out why and more every Friday live around 12pm EST on LinkedIn or X/ Twitter. Past episodes available on Youtube or your favorite podcast platform!

RWA Foundation & WALLY DAO

Check out this new ad for RWAs created by STM in-house using AI and a weekend of messing around. The WALLY DAO website is officially live! Check it out at WALLYDAO.xyz

The Power of Tokenization 🐘

— RWA Foundation (@RWAFoundation_)

11:27 AM • Jul 14, 2025

Reports

TokenizeThis 2025 Conference Review

It was great having hundreds of people in the RWA space join us at TokenizeThis 2025 earlier this year! After listening to hours worth of 50+ speakers’ insights, we’ve put together a report to summarize it all up for you.

We cover the key takeaways from each of the sessions throughout the conference, including some key quotes and themes. TokenizeThis covered topics ranging from yieldcoins & DeFi vaults for RWAs to institutional infrastructure & onchain lending. Give it a read and share your thoughts on social media - don’t forget to tag us (@Markets_Onchain on X, STM.co on LinkedIn)!

Want to watch the panels, fireside chats, and keynotes?

Find all the recordings on our YouTube!

STM’s RWA Market Prediction for 2030

STM.co is proud to release a thorough report on our prediction on the tokenized real world asset market growth. This report explores the variety of opportunities within each asset class to capture value on-chain.

Tokenization can be applied to just about any object and asset type. Art, carbon credits, life insurance, and other sub $5 trillion asset classes weren’t even considered in estimates.

In order for STM.co to derive its 2030 market predictions, the following asset classes were evaluated: currency, M2/M3, real estate, commodities, public equities, private companies and funds, bonds, credit and lending markets.

This is not financial or investment advice.

Everything in this newsletter is for informational and entertainment purposes only. Nothing in this report should be taken as financial advice or as an inducement to purchase or sell any security. Nothing in this newsletter should be used as legal advice. Always do your own research before making any decisions regarding financial transactions of securities.