- What's Drippin'

- Posts

- 🏦 Nasdaq Wants to Trade Tokenized Stocks, RedStone Acquires Credora, and More RWA News

🏦 Nasdaq Wants to Trade Tokenized Stocks, RedStone Acquires Credora, and More RWA News

Your Bi-Weekly RWA Breakdown

Enjoy a summary of the top headlines, market movements from the data team, special announcements, and Herwig’s thoughts on what’s going on in this fast-evolving space.

Without further ado, it's time to…

Get Liquid 💧

Summary and Key Takeaways

1. Today’s NASDAQ Filing for Tokenized Stocks

Just as the SEC last week announced their agenda for a crypto policy revamp, including cryptocurrencies to be tradable on national exchanges. Nasdaq wasted no time and today filed with the SEC to tokenize stocks. The idea is that holders will have the same material rights as the traditional stock counterparts. If that’s the case then they’ll be trading the tokenized stocks “on the same order book and according to the same execution priority rules,” according to Reuters. To accomplish this, the national exchange plans to work with the DTCC to clear these trades, marking an exciting time for tokenization as traditional liquidity will be making its way into tokenized stocks! Not only that but U.S. investors will finally be able to have their public stocks onchain, just as non-US investors have been experiencing for years.

This also addresses recent concerns over different types of tokenized stocks as multiple issuers have introduced the market to different structures. Some are mirrors, some are natively tokenized, and some may not be backed by the underlying at all. With that in mind, native tokenization guarantees the same investor rights while mirror tokens give non-US investors exposure to our markets with less hassle - each of these have their own value adds. While today’s news is exciting, the bottleneck lies in the SEC’s approval AND the DTCC’s infrastructure being ready for this to move forward (more likely a 2026 launch). Nonetheless, this is more forward momentum for the year and instills further confidence in the future of markets living onchain.

2. New Tokenized Stocks Now Live: Galaxy & Superstate; Ondo Global Markets

Shifting focus to LIVE tokenized stocks, this week both Superstate’s Opening Bell and Ondo Global Markets officially launched with their own value-adds to the market. Similar to what we’re seeing with Nasdaq’s proposal, Superstate is all about native tokenization and they’ve done so with Galaxy’s publicly registered shares. What does this mean? It means investors can have their shares transferred from a traditional transfer agent to Superstate’s onchain one. These are the same shares with the same rights. See an arbitrage opportunity on Nasdaq? Send your GLXY tokens back there and make the trade!

Ondo Global Markets is a bit different. Their tokenized stocks aren’t natively tokenized BUT they do bridge in traditional liquidity, giving their non-US investors the ability to access 100+ tokenized stocks and ETFs in a much more streamlined, crypto-native manner. What’s the difference? Ondo’s tokens aren’t the shares themselves but rather trackers of that stock and dividends, for example, are reinvested into that stock. Again, the point here is to give people exposure to these assets and give them additional utility in future applications on Ondo Chain. There are arguments for both models and these two announcements are making waves across the ecosystem.

3. RedStone Acquires Credora

The official oracle of choice for Securitize, RedStone, is expanding its vision beyond the trusted source of RWA asset data into ratings. Credora built a name for itself as a DeFi and RWA risk assessment provider that was backed by S&P Global and it looks the founders see the vision to become a combined force that is the premiere source for data, ratings, and more. This follows a trend of acquisitions as we enter a chapter of consolidation and growth for the sector. Whereas Chainlink owns the majority of the oracle market today, this strategic move could help build better trust with the RedStone brand and start attracting business towards this unique value proposition of risk and price tools for DeFi and RWAs.

4. U.S. Bank Brings Back Crypto Custody with NYDIG

We started the beginning of the year wondering whether the new administration would move quickly on digital asset reform. It appears that 9 months later we now have a top 5 commercial bank in the US offering crypto custody services starting with Bitcoin. That is insanely fast for regulatory reform and for a bank to move and react to. That is because for US Bank this was already underway but was a short-lived announcement back in 2021 before SAB-121 shut the partnership between NYDIG and US Bank down. As banks continue to get comfortable with Bitcoin, it’s safe to assume more services related to Bitcoin will also roll out. This will further bring in new trust and customers that never would have considered using a non-bank provider to access this asset. I mean just look at the fees BlackRock is making from their Bitcoin ETF - it’s hard not to want some of that if you are missing out on this action.

5. Raze’s $100M Private Credit Vault with Embedded Finance

Raze Finance has been in the space for a few years and we’re starting to see live, interesting issuances come to their platform. The first? Ferrox Holdings offered exposure to FerroTitanium on Redbelly Network via Raze’s platform. Here’s an interview from TokenizeThis featuring the issuer, blockchain, and platform! This week’s news expands them to the private credit asset class and more interestingly, vaults. This private credit vault with Embedded Finance comes with a $100M+ pipeline, further showing how quickly large issuances can come onchain once the infrastructure is in place. Set to launch in Q4 this year, this offering claims 8-16% returns and daily USDC distributions to your wallet. High yield, short lock up periods, and distributions onchain? This could be a good mixture for a future lender to come along and offer token holders collateralized loans against their vault tokens! Could we see something like Aave’s Horizon being implemented here next year? Absolutely.

This is not financial advice.

Notable Market Headlines

9/5 - Joint Statement from the Chairman of the SEC and Acting Chairman of the CFTC

9/4 - RedStone Acquires Credora: Strategic Expansion Into Risk Ratings

9/4 - US SEC unveils agenda to revamp crypto policies, ease Wall Street rules

9/4 - Power Metal Resources Announces Proposed £3 Million Investment in Minestarters

9/4 - tZERO Names Alan Konevsky CEO as Company Looks Ahead to Growth in Digital Asset Markets

9/3 - Galaxy and Superstate Launch GLXY Tokenized Public Shares on Solana

9/3 - Ondo Launches Global Markets: 100+ Tokenized U.S. Stocks on Ethereum

9/3 - Utila Raises $22M, Triples in Valuation as Stablecoin Infrastructure Demand Surges

9/3 - Raze & Embedded Finance Launch $100M+ Tokenized Private Credit Vault

9/3 - StratX Launches Compliance-Aware Routing Protocol for Stablecoins, RWAs, and Cross-Border Settlement

9/3 - Polychain Capital Co-leads $15M Funding for IP Tokenization Platform Aria

9/3 - RWA tokenization enters new phase with AI servers as latest asset class

9/3 - US Federal Reserve to hold conference with focus on stablecoins, tokenization

9/2 - SEC-CFTC Joint Staff Statement (Project Crypto-Crypto Sprint)

9/2 - European Commission eyes December proposals tied to RWA tokenization, adviser says

9/2 - Finloop Unveils Asia's First Comprehensive Technical Solution for Hong Kong Stock Tokenization

9/2 - Thailand Moves Toward Launch of World's First Publicly Offered Tokenized Government Bond

9/2 - XStocks launches on Ethereum with 60 tokenized stocks, including Nvidia and Tesla

9/1 - From Trade Finance to DeFi: An Interview on XDC Network's Strategic Investment in Kasu Finance

9/1 - Trump mulls post-war Gaza plan featuring tokenized land

Institutional Activity

9/3 - US Bancorp revives institutional bitcoin custody service

9/3 - Boerse Stuttgart launches pan-European settlement platform for tokenized assets

9/1 - Hong Kong issues world’s first offshore yuan tokenised public bond

9/1 - Seoul launches real estate fractional investment initiative using closed police boxes

RWA Foundation & WALLY DAO

The RWA Foundation introduced the RWA Pod as “A permissionless way for anyone to support RWAs using crypto with multiple RWA project tokens as yield.”

What if anyone with access to crypto could get in on the success of RWAs? Launching on September 15th, the RWA Pod enables users to stake crypto in order to earn RWA project tokens as yield. In partnership with PERQ, the RWA Pod will remain open for 90 days allowing users to deposit ETH, USDC (on Base), ARB, and S/ Sonic. Participants will receive tokens on multiple blockchain protocols related to RWA projects that the RWA Foundation has qualified and selected as Founding Members.

The yield from crypto staking is sent from the RWA Pod to the RWA Foundation in order to be converted into RWAs. These RWAs will seed a designated treasury designed to launch WALLY, the native token of the WALLY DAO by the RWA Foundation.

There are more details so make sure to read the full announcement, set your reminders, tell your friends, and get ready for The RWA Pod launching on September 15th!

Special Announcement

The NYC RWA Meetup is hosting Capital Markets & Cocktails: The Institutional RWA Event on 9/15 @ 6:30pm at Unveiled Bar Room.

Sponsored by Chainlink, Hypernative, and Transparent Capital, this is our sixth NYC RWA Meetup — now 1,000+ members strong. At our last event, we hosted Plume and the ex-Head of Digital Assets at Goldman Sachs.

STM.co Data

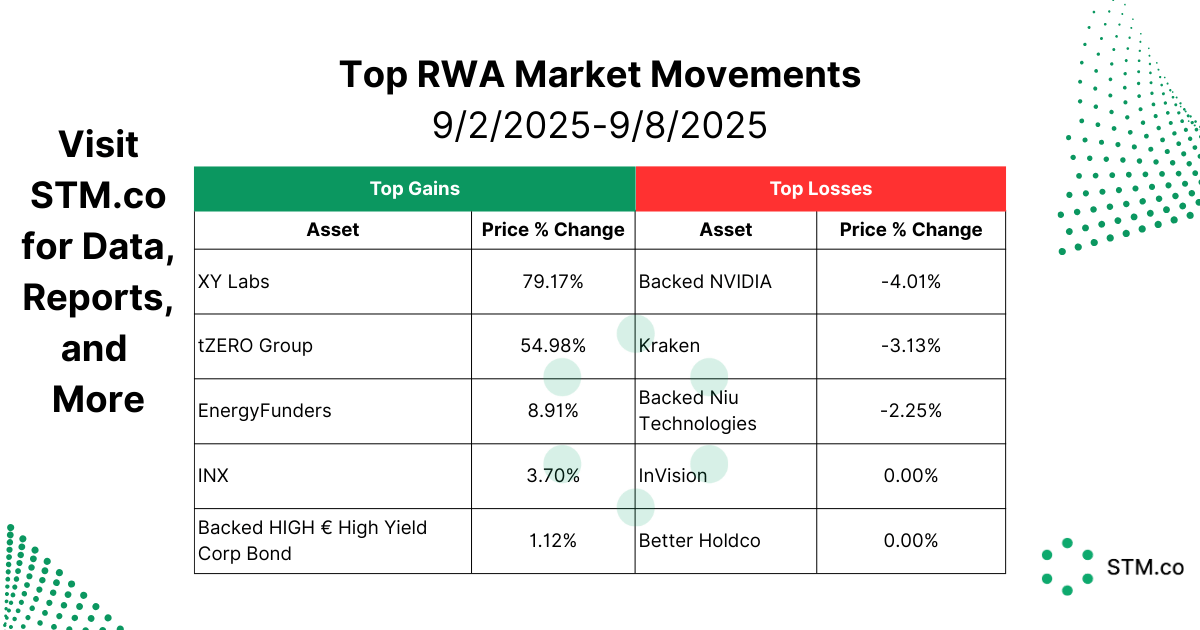

The market is hot this past week with tZERO’s platform clearly leading the charge given the top 3 gainers are all hosted on their marketplace. This is no surprise as this past week the board replaced David Goone with Alan Konevsky as CEO in response to Bed, Bath, and Beyond’s letter requesting the former CEO’s replacement. tZERO’s community has long been waiting for more updates and action, therefore this announcement has sparked additional confidence in the platform.

How does this affect the markets? Those looking for exposure to tZERO due to this announcement likely went there first and then saw other offerings also on the platform like XY Labs and EnergyFunders. Of course this isn’t certain but a likely scenario explaining the increased volume and price change. So what’s next for the platform? Keep an eye out for Alan’s next moves, building on top of their partnership with Lynq Network, tZERO chain, and more.

This is not financial advice.

Think Like Herwig

Hello readers,

We’re off to a great start this week with wind in the industry’s sails from last week’s GLXY tokenization on Superstate, the launch of Ondo Global markets, Aave’s Horizon hitting $100M deposits in a week, and more great RWA news! That will no doubt be the same this week as we already start off with the news from NASDAQ. The pace of RWA adoption is rapidly accelerating and next week is the launch of the RWA Pod by the RWA Foundation alongside several events like RWA Summit/ Capital Markets & Cocktails, Meridian by Stellar, and Korea Blockchain Week kicks off a week later. Next thing you know it’s Singapore 2049 which is a coup de grâce of announcements as the final major event of the year.

If you haven’t learned about the RWA Pod and how it is the first opportunity to get WALLY and 9 other RWA project tokens with it just for staking your crypto, then you need to read this!

Happy tokenizing,

Herwig “Happy” Konings

CEO, Security Token Group

💦 What Else is Drippin’

Companies of the Week

Company of the Week - Herwig: Galaxy

Company of the Week - Kyle: Ondo

Find out why and more every Friday live around 12pm EST on LinkedIn or X/ Twitter. Past episodes available on Youtube or your favorite podcast platform!

Reports

RWA Tokenization: Key Trends and 2025 Market Outlook

Check out a report we contributed to: RWA Tokenization: Key Trends and 2025 Market Outlook. Led by Brickken, this report brings multiple parties together in diving into tokenization, with STM.co supporting with both data and some of the written sections.

What’s Inside?

✅ A Breakdown of Tokenization and Related Benefits

✅ Key advantages for issuers, investors, and institutions

✅ How the market is evolving and trends shaping adoption in 2025

✅ What’s next? Expert insights on regulation, DeFi integration, institutional involvement, and market growth

STM’s RWA Market Prediction for 2030

STM.co is proud to release a thorough report on our prediction on the tokenized real world asset market growth. This report explores the variety of opportunities within each asset class to capture value on-chain.

Tokenization can be applied to just about any object and asset type. Art, carbon credits, life insurance, and other sub $5 trillion asset classes weren’t even considered in estimates.

In order for STM to derive its 2030 market predictions, the following asset classes were evaluated: currency, M2/M3, real estate, commodities, public equities, private companies and funds, bonds, credit and lending markets.

This is not financial or investment advice.

Helpful Resources

$30 Trillion by 2030 - STM

Tokenizing an Asset in 3 Easy Steps - Security Token Show

Tokenization for Institutions - What You Need to Know - STM, Arca (YouTube)

We hope you enjoyed this week's What’s Drippin’ email - if you have any feedback on either what you liked or what you’d like to see, please reply to this email with it.

Everything in this newsletter is for informational and entertainment purposes only. Nothing in this report should be taken as financial advice or as an inducement to purchase or sell any security. Nothing in this newsletter should be used as legal advice. Always do your own research before making any decisions regarding financial transactions of securities.