- What's Drippin'

- Posts

- 👑 Lil Pump is making us all royalty 🎤

👑 Lil Pump is making us all royalty 🎤

Lil Pump is giving investors royalty rights to his music!

Welcome to the 49 new Rainmakers who have joined us since last week. Join the 2,629 others who are laughing, learning, and staying at the forefront of tech every week!

Gooood morning, Rainmakers! ☀️

As always, I have two captivating topics for you to dive into:

1️⃣ 👑 Lil Pump is making us all royalty: Lil Pump is giving investors royalty rights to his music via an STO.

2️⃣ 💄 The 1st equity-backed security token IPO: Oddity, a beauty-focused tech platform, plans to do something a company has never done before!

Without further ado, it's time to…

Get liquid 💧

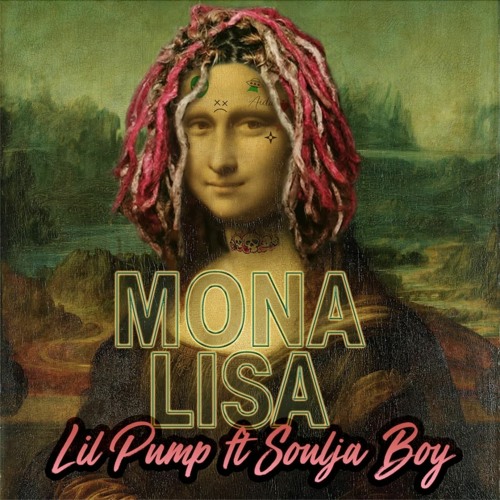

👑 Lil Pump is making us all royalty 🎤

Remember those music Security-NFTs launched by Republic and Opulous a few months back?

Well, guess what, they're back... back again with a foolproof plan!

Opulous has officially partnered with Securitize to help with the facilitation of trading and investing in S-NFTs!

Securitize will be acting as the transfer agent and issuance platform to mint and issue the tokens to the eligible investors.

The tokens will be trading on the Opulous S-NFT proprietary trading platform... "supposedly."

I say supposedly because in order to legally trade securities in the US you have to do it through a registered BD/ATS.

If you don't it's a very gray area.

There are ways to whitelist investors to trade on decentralized platforms, but as I said, it's gray.

The good thing about this is if Opulous decides not to enter the gray area, they can easily list them on the Securitize Markets ATS - avoiding potential securities law violations.

And for those wondering what an S-NFT is, it's really a security and not an NFT at all.

My guess for the reason they call it a 'Security-NFT' is for marketing purposes, so the average person will understand it better.

Regardless of what you call it, we are talking security tokens representing royalties in HUGE music artists' singles!

Take a look at the upcoming and completed offerings directly sourced from the Opulous website:

Imagine having the rights to royalties to your favorite music artists!

Stop imagining! This is a reality now.

Investors receive a wide range of benefits including the rights to royalties the single earns, DeFi staking and lending, secondary liquidity, and more!

This is massively advantageous from the artists' point of view as well.

How?

The artists receive upfront capital via the offering in exchange for a percentage of the royalty rights of their music.

In this case, Lil Pump raised $500K before the single was even released!

The single is now released and honestly pretty catchy! What do you think?

By receiving cash upfront for this single, it protected Lil Pump against the downside in the scenario the single flops and doesn't earn a substantial revenue.

Cash is king!

Let's just hope Lil Pump knows a thing or two about securities laws and doesn't try to 'pump' his security too much or he may get in trouble with the SEC.

All jokes aside, this is super cool to me and will surely be a catalyst that brings security tokens to the mainstream.

Stay tuned to see what other artists follow this route!

💄The 1st equity-backed security token IPO

Imagine this...

It’s IPO day and your favorite company is finally available on a public exchange!

The problem is when you invest the valuation is already likely sky-high.

The investors that had the opportunity to invest at lower valuations are feeling super happy, but you aren't.

That’s odd, isn’t it?

Why can’t you get in early?

Imagine investing in Apple or Amazon before their IPO.

You would be rich!

Luckily, due to the power of tokenization, it doesn't have to be an 'odd' thing anymore!

The company Oddity, which is a consumer tech platform built to transform the $600B global beauty and wellness market, plans to allow investors to get in before the IPO.

This will be a security token equity-backed IPO, the first of its kind!

Of course, we had the INX security-token backed IPO last year, but INX offered profit-sharing rights... not equity!

The investment gets more interesting, as they are enabling investors to invest at a 20% discount of the IPO price.

Let's take a quick look at the deal terms.

Deal Terms:

Offering Platform: Securitize

Structure: Fixed discount convertible with a 20% discount to IPO initial share price

Price/Token: $1,000

Minimum Investment Amount: $1,000

Launch Date: 04/26/22

Deadline: 05/11/22

Allowed Investors: US accredited

Put simply, they are merely doing a tokenized primary offering at a lower valuation than the planned IPO valuation, with the tokens restricted from trading until the IPO launches.

So, it doesn't look like these tokens will be trading, but they will add to the firepower in the security token primary issuance market.

This is just another unique use-case of security tokens at work!

💦 What else is Drippin’

STM X Arca: The first episode of our six-part series with Arca: "Tokenization for Institutions: What You Need to Know" just dropped!

Goldman Sachs Makes Its First Bitcoin-Backed Loan: The global investment bank allowed a borrower to use the cryptocurrency as collateral for a cash loan.

Hogan Lovells advises on the first Art Security Token Offering by a European Museum: Art is becoming a common use case for tokenization!

Thanks for tuning in! Keep an eye out each Monday for the next security token adventure 🧗♀️

Disclosures:

• No money or other consideration is being solicited, and if sent in response, will not be accepted;

• No offer to buy the securities can be accepted and no part of the purchase price can be received until the offering statement is filed and only through the platform of an intermediary (funding portal or broker-dealer); and