- What's Drippin'

- Posts

- ⚠️ Project Crypto, tZERO Chain & Token, Potential Fraud and More

⚠️ Project Crypto, tZERO Chain & Token, Potential Fraud and More

Your Bi-Weekly RWA Breakdown

Welcome to the Monday edition of What’s Drippin’. Enjoy a summary of the top headlines, market movements from the data team, special announcements, and Herwig’s thoughts on what’s going on in this fast-evolving space.

Without further ado, it's time to…

Get Liquid 💧

Summary and Key Takeaways

1. The SEC Announces Project Crypto

This SEC continues to make historic action to modernize the agency's ability to serve the financial markets. The SEC has now released the Project Crypto announcement just in case there was still anyone out there that thought this regime had ANY Gensler-era views still residing within them. This is calling for modernizing the rules to account for digital assets and onchain financial activity, including going beyond how ambiguously the Howey Test can be applied to these new platforms. It’s great that Paul Atkins and peers want clear definitions for what classifies as a security, commodity, stablecoin, or collectible. From a sentiment standpoint, it’s great to hear the SEC’s shift in approach from the previous administration to now prioritizing commercial viability and innovation over outdated regulations when something doesn’t fit neatly into today’s rules.

Specifically for RWAs, Project Crypto is looking to address tokenized stocks, bonds, and other traditional instruments coming onchain by providing safe harbors and exemptions which ultimately helps the United States keep its strong position in capital formation, now onchain. To facilitate this further we also saw superapp licenses come into the conversation, helping compete globally as well as make this convergence of TradFi and DeFi more streamlined for the end user. July has been refreshing with the progress from the first 6 months of the year and announcements made for the second half.

2. JPMorgan and Coinbase Partner for Direct Integration, Coinbase’s Expansion to RWAs and More

Similar to how last week we covered BNY offering a tokenized money market fund via LiquidityDirect, next to traditional assets, JPMorganChase is starting to do the same. Giving a crypto audience an easy way to connect their accounts and convert credit card points into USDC on Base is a start in getting investors familiar with tokenized assets and crypto living alongside their traditional assets. This is very obviously hinting at eventually this simple API integration to evolve into using JPM’s tokenized deposit token (JPMD) in the Coinbase ecosystem at retail level, which by the way is issued on Coinbase’s Base blockchain.

This is great timing with Brian Armstrong and team continuing talks about bringing multiple assets and prediction markets to their “everything exchange”, including securities. RWAs are the holy grail here and the competition is getting more intense with the large exchanges all diving in, from Coinbase to Gemini, Kraken, Robinhood and more. That being said, the real question is who’s going to “do it right”?

3. tZERO Announces Blockchain and Utility Token

We’ve been talking about this for a while now on The Security Token Show, in conversation with peers in the industry, and of course at the RWA Foundation which is the fact that multiple RWA infrastructure companies will be issuing their own utility tokens. This is the most direct way to interact with and build a crypto-native audience in addition to their traditional investor bases while building an ecosystem to support the RWAs issued on, in this case, tZERO. The tZERO Chain and $TZERO utility token are a great way to finally bring the full lifecycle of the asset onchain including their ATS, custody and settlement, as well as transfer agent services, winning them Herwig’s Company of the Week.

What else does it mean? DeFi applications/ onchain financial services. From borrowing & lending to leverage loops, it’ll be interesting to see what gets built out first. Do you know what L1 this L2 built on? We’ll keep doing some digging but as Herwig and Kyle covered on the show it wouldn't be a big surprise if it’s Aptos given that’s where two of tZERO’s business development team moved to.

4. HSBC Starts Accepting Tokenized Deposits From Corporate Clients

On a similar note to JPMorgan’s deposit token, HSBC is now offering tokenized deposits in Hong Kong for their corporate clients as a part of their Project Ensemble with the HKMA. This platform is starting with payments, making it easier to exchange between USD and HKD to have 24/7 financial services. The cash leg is a start and this only signals positive momentum as they get corporate clients comfortable using a basic asset onchain. The first to give it a try? Ant Financial out of Singapore. Eventually one can expect this to expand to offer other assets that were issued on HSBC Orion such as fixed income products.

5. Allegations Against RealT and Their Tokenized Real Estate

RWA tokenization is seeing its best moments this year however it doesn’t mean it’s perfect. Allegations have been made around an early real estate tokenization engine RealT and the City of Detroit has taken action. RealT has been accused of committing fraud, raising $2.72 million for 39 homes in Detroit they don’t own in addition to code and tax violations at 408 properties. Although they took over management of the properties according to the article, the issue is with ownership of the homes and therefore what backs the security tokens.

Of course there’s also two sides to each story, which we hope we can get their CEO Remy Jacobson to join us on the Security Token Show for. On Friday’s episode Herwig also brings up the possibility of this mimicking with what we saw with Uber and the taxi cab industry as RealT sells these assets majorly to non-US investors, distributing yield to them and potentially paying less or no property sale taxes due to ownership structure enabling investors to trade a corporation instead of the title itself which is warehoused in the corporation itself. At this point these are allegations and the STM.co team will continue to investigate.

This is not financial advice.

Notable Market Headlines

8/4 - Tokenization Specialist Centrifuge Appoints Former Goldman Sachs Executive as COO

7/31 - tZERO to Launch tZERO Chain and Utility Token to Power Regulated Asset Tokenization at Scale

7/31 - Coinbase says it's launching tokenized stocks, predictions markets for U.S. users in coming months

7/30 - Brazil's VERT Capital to Tokenize $1B in Real-World Assets on XDC Network

7/29 - IONOS’ InternetX plans to tokenize 22M domains through Doma Protocol

7/28 - Xend and Risevest partner to offer users access to U.S assets

7/25 - Detroit Is Suing a Florida Crypto Real Estate Company Over RWA Ponzi Scheme

Institutional Activity

8/4 - French Custody Bank CACEIS Backs Tokenized SME Exchange in Europe

8/1 - SEC debuts 'Project Crypto' to bring U.S. financial markets 'on chain'

7/30 - JPMorganChase and Coinbase Launch Strategic Partnership to Make Buying Crypto Easier than Ever

7/29 - Crypto Fund JellyC Teams Up With Standard Chartered, OKX for Secure Crypto Trading

7/28 - Exclusive: Seoul unveils stablecoin bill to defend monetary sovereignty

7/28 - BNP Paribas goes live on DLT settlement system Fnality, executes swap payment

RWA Foundation & WALLY DAO

Check out this new ad for RWAs created by STM in-house using AI and a weekend of messing around. The WALLY DAO website is officially live! Check it out at WALLYDAO.xyz

The Power of Tokenization 🐘

— RWA Foundation (@RWAFoundation_)

11:27 AM • Jul 14, 2025

STM.co Data

As the month comes to a close we’d like to take a look at this month’s top gainers and losers. Not happy with your placement? No worries, there’s still 4 days left in the month!

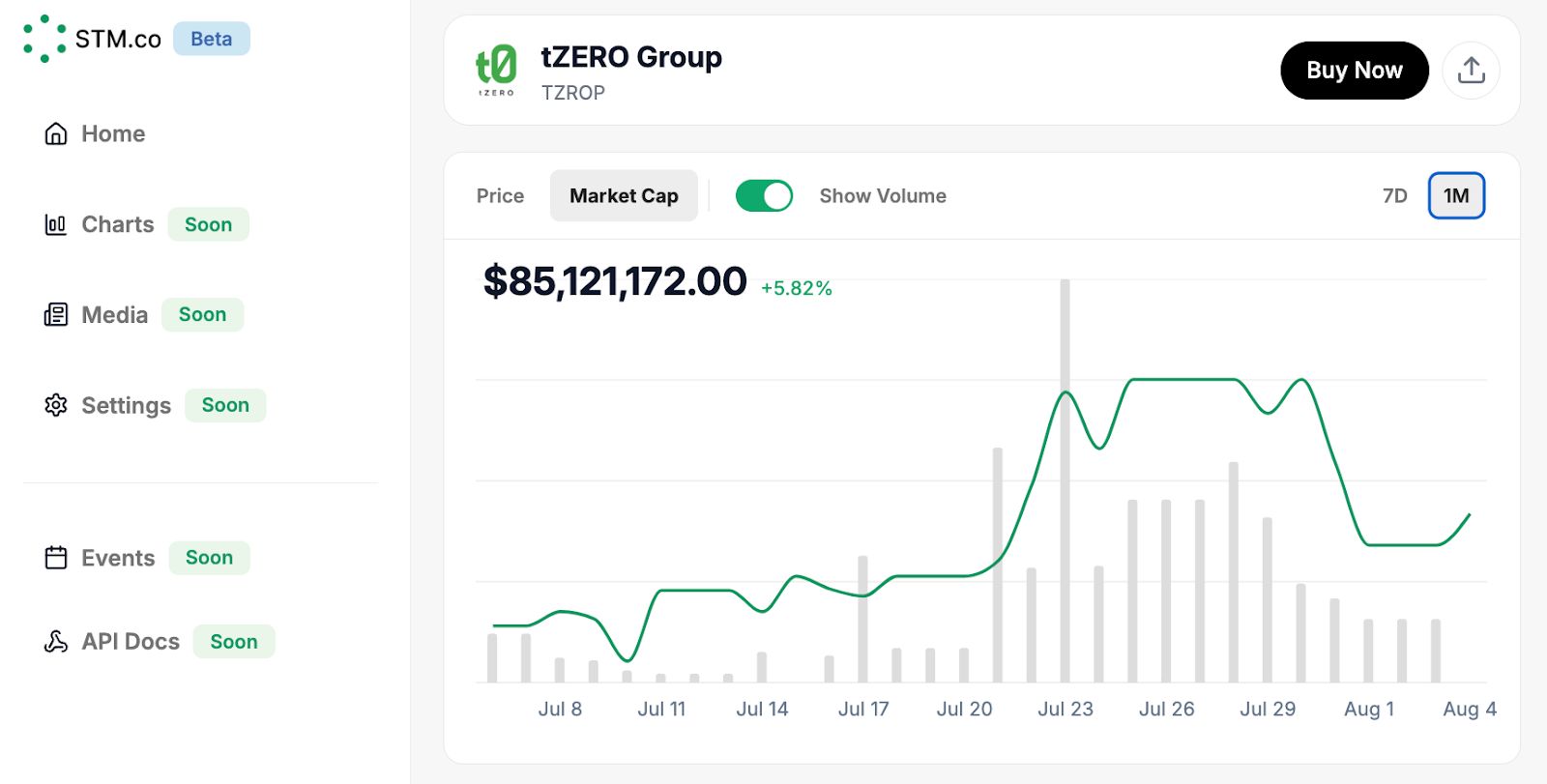

Over the past week, the tokenized RWA market has seen mostly a decline, with some tokenized bonds and funds inching up modestly while a few digital equity tokens saw steep selloffs. Most striking is tZERO Group, whose tokenized preferred shares (TZROP) dropped 23.45% in the week. The selloff corresponds with a sharp decline in market cap visible on the STM.co chart, beginning in late July. This drawdown may be tied to potential investor uncertainty surrounding tZERO’s broader strategy, particularly the mixed reception to updates on its utility token and blockchain pivot.

While Aspen Coin led the gainers with a 1.67% rise, the broader movement suggests capital is rotating into stable income-producing tokenized products like treasuries and credit funds, with modest upticks in IBTA and GOVIES-backed offerings. Republic Note and CMSTR Note also saw steep losses, hinting at growing investor scrutiny of tokenized venture or equity-linked notes amid backing and liquidity questions.

This is not financial advice.

Think Like Herwig

Hello readers,

WHAT A TIME TO BE ALIVE! Seriously, if you have been in RWAs as long as I have you must be experiencing the same constant joy I get dosed with every day this year so far. Tokenization growth record numbers, legislation passing, SEC endorsements, and DeFi converging (pun intended) on TradFi. With the renewed emphasis on the technology, we’ve seen a rush of new L1/L2 tokenization-specific chains based on privacy or some other ecosystem factor typically. It’s led to a spur of new broker-dealers and licensing activity again. Stablecoin predictions have spiraled into trillions of dollars in growth in short order. And most glorious of all, RWA project tokens (utility, governance, unregulated) are having their moment too, and I believe will only continue to do so - not financial advice, I am just sharing my opinion shaped from my experience in this space since 2015. If you haven’t figured out how you are going to react to this evolving market and technology whether you are a degen, a banker, or just Joe Schmoe trying to live their lives, you're going to miss the most exciting revolution to happen to crypto and finance since the invention of the stock certificate or even money itself.

Happy tokenizing,

Herwig “Happy” Konings

CEO, Security Token Group

💦 What Else is Drippin’

Companies of the Week

Company of the Week - Herwig: tZERO

Company of the Week - Kyle: Coinbase

Find out why and more every Friday live around 12pm EST on LinkedIn or X/ Twitter. Past episodes available on Youtube or your favorite podcast platform!

Reports

RWA Tokenization: Key Trends and 2025 Market Outlook

Check out a report we contributed to: RWA Tokenization: Key Trends and 2025 Market Outlook. Led by Brickken, this report brings multiple parties together in diving into tokenization, with STM.co supporting with both data and some of the written sections.

What’s Inside?

✅ A Breakdown of Tokenization and Related Benefits

✅ Key advantages for issuers, investors, and institutions

✅ How the market is evolving and trends shaping adoption in 2025

✅ What’s next? Expert insights on regulation, DeFi integration, institutional involvement, and market growth

STM’s RWA Market Prediction for 2030

STM.co is proud to release a thorough report on our prediction on the tokenized real world asset market growth. This report explores the variety of opportunities within each asset class to capture value on-chain.

Tokenization can be applied to just about any object and asset type. Art, carbon credits, life insurance, and other sub $5 trillion asset classes weren’t even considered in estimates.

In order for STM to derive its 2030 market predictions, the following asset classes were evaluated: currency, M2/M3, real estate, commodities, public equities, private companies and funds, bonds, credit and lending markets.

This is not financial or investment advice.

Helpful Resources

$30 Trillion by 2030 - STM

Tokenizing an Asset in 3 Easy Steps - Security Token Show

Tokenization for Institutions - What You Need to Know - STM, Arca (YouTube)

We hope you enjoyed this week's What’s Drippin’ email - if you have any feedback on either what you liked or what you’d like to see, please reply to this email with it.

Everything in this newsletter is for informational and entertainment purposes only. Nothing in this report should be taken as financial advice or as an inducement to purchase or sell any security. Nothing in this newsletter should be used as legal advice. Always do your own research before making any decisions regarding financial transactions of securities.