- What's Drippin'

- Posts

- 🏦 CME Tokenization Updates, Apex, Fine Wine, and More RWA News

🏦 CME Tokenization Updates, Apex, Fine Wine, and More RWA News

Your Bi-Weekly RWA Breakdown

Welcome to the Monday edition of What’s Drippin’. Enjoy a summary of the top headlines, market movements from the data team, special announcements, and Herwig’s thoughts on what’s going on in this fast-evolving space.

Without further ado, it's time to…

Get Liquid 💧

Summary and Key Takeaways

1. BNY Tokenizes MMF on Goldman Sachs’ GS DAP, Available on LiquidityDirect

This is the beginning of institutions pushing tokenized products to their clients on their normal platforms. What does that mean? In this case it means that BNY’s clients get to subscribe and redeem from the fund just as they would to any other - via their LiquidityDirect platform. Although the money market fund units will be tokenized separately on GS DAP as “mirror tokens”, it’s a start in getting investors familiar with tokenized assets living alongside their traditional counterparts. This will help train them, setting them up for success when more advanced use cases like collateral mobility are enabled in tokenized form.

2. CME Updates on Tokenization Efforts

Speaking of collateral mobility, CME Group operates the world’s largest derivatives exchange and they just gave an update saying they’re looking at both collateral mobility (cash and non-cash) as well as clearing. The fact that tokenization is coming up on earnings calls more recently is signaling people’s growing knowledge of this technology. Their COO shared that they’re now in phase 2 of testing with a focus on their relationship with settlement banks followed by clearing members and clients. When can we expect something to go live? 2026 and it’ll likely be the collateral margin use case given how many examples we’ve seen of tokenized liquidity products being used for that purpose on crypto prime brokerages.

3. Apex Group Partners with ZIGChain to Build Shariah-Compliant Tokenized Fund Infrastructure

Apex Group is full steam ahead on tokenization following their recent acquisition of Tokeny. Coming out of the UAE, this headline shares Apex’s new partnership with ZIGChain for tokenized fund infrastructure and they’re tapping in many more to help put it together including Truleum Venture Partners, Tokeny, Disrupt.com, and Zamanat. This is already a great example of a TradFi player making their way into the web3 space and even faster now owning key infrastructure, making their ability to expand services a whole lot easier.

4. Commissioner Peirce Seeks Cross Border Regulatory Collaboration with UK’s FCA While Also Exploring Ethereum Smart Contract Standards for Compliance

This SEC is truly on a roll and setting the stage for a historic term that will be remembered for transforming and modernizing capital markets rules. We’ve covered in the past how the SEC was already working with the regulators from El Salvador to learn from their digital assets expertise. Now we’ve learned last week that the SEC is doing the same with our brothers and sisters across the pond in the UK. This level of global collaboration will not only guide the SEC better but also lead to standardization for cross-border securities transactions that are now occurring constantly (and with ease!) using the blockchain.

That’s why smart contract standards for securities compliance can be a critical tool and is also something that the SEC Crypto Task Force has met with industry experts including the ERC3643 association in order to better understand.

5. Savea’s Tokenized Wine Index

Alternatives are interesting investment opportunities and we’ve seen quite a few in the tokenization space from diamonds to wine. This one’s looking to bring an index onchain, giving those of us non-sommeliers a better chance at a return than choosing a bottle over another (not financial advice). Savea’s SAVW token essentially tracks the Liv-ex 1000 fine wine index with onchain access for subscriptions and redemptions, 24/7. Even though the index product itself isn’t tokenized natively yet, even having an onchain tracker for now is a start, giving investors a vehicle that has historically delivered around 8% compared to tokenized liquidity products currently at 4-5%.

This is not financial advice.

Notable Market Headlines

7/24 - MultiBank.io Collaborates with Fireblocks to Bring $10 Billion RWA Vision to Life.

7/24 - Binance integrates Tokenized Real-World Assets USYC and cUSDO into Off-Exchange Settlement Solutions

7/22 - Archax Group set to acquire Deutsche Digital Assets, further extending EU footprint

7/22 - Particula assigns a BBB+ rating* to the issuance of the $DSC token by Denario

7/21 - RWA ltd to Launch Worlds First Non Financial RWA Trading Platform

7/21 - Ethena Foundation to spin up SPAC called StablecoinX dedicated to buying millions worth of ENA

7/20 - Tokenize Xchange to exit Singapore after being denied digital payment token licence

7/18 - KuCoin launches xStocks, delivering access to global tokenized equities

7/17 - Figure Technology Solutions and Figure Markets Merge to Transform Capital Markets via Blockchain

7/17 - Plume And Colb Finance Partner To Bring Pre-IPO Equities Onchain

7/17 - Anti-CBDC Surveillance Act shouldn't prevent wholesale CBDC, tokenized reserves

7/17 - Axiology lands 4th EU DLT Pilot Regime license for digital bonds

Institutional Activity

7/24 - MUFG, Japan's largest bank to tokenize real estate for retail investors

7/24 - $1.6 trillion Franklin Templeton taps VeChain to expand distribution of its tokenized treasury fund

7/24 - Apex Group and ZIGChain Forge Strategic Alliance to Launch Tokenized Fund Infrastructure

7/23 - BNY, Goldman Sachs partner to tokenize money market funds

7/23 - WisdomTree’s USDW stablecoin to pay dividends on tokenized assets

7/21 - SEC explores Ethereum token standard for compliant securities

7/21 - SEC's Peirce expands on UK cross border tokenization sandbox. EU not invited

7/21 - BioSig to Secure Up to US$1.1 Billion in Financing for Gold-Backed Tokenization

7/18 - Securitize Takes Tokenized Hamilton Lane Credit Fund Multichain, Bringing It Closer to DeFi

RWA Foundation & WALLY DAO

Check out this new ad for RWAs created by STM in-house using AI and a weekend of messing around. The WALLY DAO website is officially live! Check it out at WALLYDAO.xyz

The Power of Tokenization 🐘

— RWA Foundation (@RWAFoundation_)

11:27 AM • Jul 14, 2025

STM.co Data

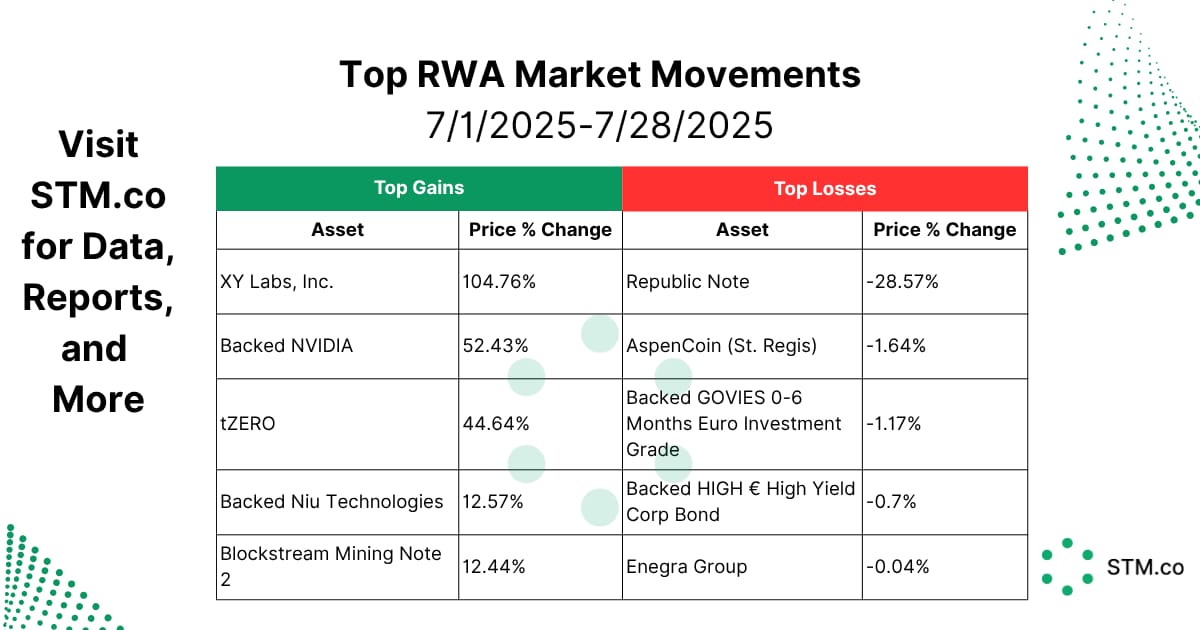

As the month comes to a close we’d like to take a look at this month’s top gainers and losers. Not happy with your placement? No worries, there’s still 4 days left in the month!

The tokenized asset market saw notable divergence in July, with XY Labs skyrocketing to over 100%, leading the pack of top gainers. Backed NVIDIA and tZERO followed with strong double-digit gains, reflecting growing investor confidence in tokenized equity and infrastructure plays. On the flip side, Republic Note experienced a sharp decline of -28.57%, standing out as the biggest underperformer. Given Republic’s new mirror tokens offer exposure to individual, household-name companies like SpaceX and Canva vs. a portfolio, perhaps this signals some investors’ strong preference to allocate into them.

This is not financial advice.

Think Like Herwig

Hello readers,

The GENIUS Act has opened the doors for stablecoins to flourish and, with it, RWAs will too! While the CLARITY act may come before year’s end, so might another bill that fewer are talking about. This is the Equal Opportunity for All Investors Act of 2025 which would designate the creation of a test for anyone to pass to qualify as an accredited investor. It passed unanimously in the house and is now off to the Senate.

Meanwhile, banks across the country are feeling the pressure turn up. If crypto markets continue to grow, we may see a feeding frenzy around this technology, especially if RWAs become the face of this cycle… which may already be the case!

Happy tokenizing,

Herwig “Happy” Konings

CEO, Security Token Group

💦 What Else is Drippin’

Companies of the Week

Company of the Week - Herwig: Kamino Finance

Company of the Week - Kyle: BioSig

Find out why and more every Friday live around 12pm EST on LinkedIn or X/ Twitter. Past episodes available on Youtube or your favorite podcast platform!

Reports

RWA Tokenization: Key Trends and 2025 Market Outlook

Check out a report we contributed to: RWA Tokenization: Key Trends and 2025 Market Outlook. Led by Brickken, this report brings multiple parties together in diving into tokenization, with STM.co supporting with both data and some of the written sections.

What’s Inside?

✅ A Breakdown of Tokenization and Related Benefits

✅ Key advantages for issuers, investors, and institutions

✅ How the market is evolving and trends shaping adoption in 2025

✅ What’s next? Expert insights on regulation, DeFi integration, institutional involvement, and market growth

STM’s RWA Market Prediction for 2030

STM.co is proud to release a thorough report on our prediction on the tokenized real world asset market growth. This report explores the variety of opportunities within each asset class to capture value on-chain.

Tokenization can be applied to just about any object and asset type. Art, carbon credits, life insurance, and other sub $5 trillion asset classes weren’t even considered in estimates.

In order for STM to derive its 2030 market predictions, the following asset classes were evaluated: currency, M2/M3, real estate, commodities, public equities, private companies and funds, bonds, credit and lending markets.

This is not financial or investment advice.

Helpful Resources

$30 Trillion by 2030 - STM

Tokenizing an Asset in 3 Easy Steps - Security Token Show

Tokenization for Institutions - What You Need to Know - STM, Arca (YouTube)

We hope you enjoyed this week's What’s Drippin’ email - if you have any feedback on either what you liked or what you’d like to see, please reply to this email with it.

Everything in this newsletter is for informational and entertainment purposes only. Nothing in this report should be taken as financial advice or as an inducement to purchase or sell any security. Nothing in this newsletter should be used as legal advice. Always do your own research before making any decisions regarding financial transactions of securities.