- What's Drippin'

- Posts

- 💸 Aave's Savings App, Trump's Maldives Resort, Ondo Expands to EU and More

💸 Aave's Savings App, Trump's Maldives Resort, Ondo Expands to EU and More

Your Bi-Weekly RWA Breakdown

Enjoy a summary of the top headlines, market movements from the data team, special announcements, and Herwig’s thoughts on what’s going on in this fast-evolving space.

Without further ado, it's time to…

Get Liquid 💧

Summary and Key Takeaways

1. Aave Labs Announces High-Yield Savings App, Rate Boosts Up to 9%

The DeFi space continues to go after the traditional banking options we have today, with Aave Labs being the latest to challenge checking and savings accounts offering a base of 5%. They announced that 12,000+ banks and debit cards will be supported for onboarding (likely a Plaid integration), making it easier for people to onboard onto the app (and of course stablecoins). Want more than 5%? Aave is incentivizing users to dive deeper into their ecosystem with higher rates depending on actions such as going through KYC, referring friends, setting up automatic deposits, and more. That said, there’s always a concern over the protection of those deposits. Aside from borrowers having to overcollateralize, even depositors at just the base rate will be protected up to $1M per account thanks to “insurance-backed protection”. This is substantially higher than the typical FDIC-insured account insured up to $250K which is a big win. However details on what events are covered and whatnot are not available yet and of course everyone should do their own research.

For Aave, this is a great way to continue driving the DeFi narrative forward and challenge TradFi while also incentivizing users to essentially grow Aave’s lending pools which of course is good for both everyday users and the increasing adoption of institutional DeFi through their Horizon instance. As a quick reminder, Horizon is the part of Aave where one could borrow against their BUIDL, VBILL, USTB, etc. For anyone interested, the app is now available for download on iOS and coming soon to Android and web with the whole service currently in waitlist mode.

2. Ondo Expands to EU and Invests $25M in Figure’s YLDS

Ondo Global Markets has been growing quickly and now they’re looking to grow even further as they prepare to onboard European investors thanks to an approval from the Liechtenstein Financial Market Authority (FMA). This approval passports Ondo GM to the EU and European Economic Area (EEA), coming just a couple of weeks after they partnered with BX Digital to offer their tokenized stocks and ETFs in Switzerland. These two expansions will catalyze more inflows to Ondo GM from big markets but also introduces them as new competition in those markets, going against the others already there such as Swarm and Backed Finance’s xStocks. It’ll be interesting to see where European investors ultimately decide to transact their exposure to US public markets over time. This isn’t Ondo’s only news, however, as they also deploy $25M into Figure’s YLDS as a new backer of Ondo’s OUSG product. As a refresher, YLDS isn’t just a stablecoin, it’s a publicly-registered security that pays interest. Aside from diversifying Ondo’s OUSG backing, for Figure this means new capital to use in their Democratized Prime ecosystem.

3. Figure Files for Public Blockchain-Native Equity Offering

Speaking of Figure, Ondo’s $25M YLDS investment is just the beginning of exciting news coming from them as they too are looking to tokenize their stock and filed and S-1 to do so. Aren’t they already public? Yes they are, under the ticker $FIGR, and that’s where this gets interesting. It’s not supposed to be dilutive, but more so a secondary/follow-on offering. The blockchain-native stock will be tradable with Figure’s Class A Common Stock (FIGR) on a one-for-one basis. To do this, existing investors will sell FIGR to underwriters Goldman Sachs, Morgan Stanley, and Cantor before the offering. Once the offering goes live, as people invest in the new blockchain-native share class (settling in YLDS of course), Figure will buy the FIGR common stock from the underwriters. This offering brings increased utility to Figure’s equity and takes full advantage of the blockchain, specifically Provenance Blockchain, along with removing intermediaries such as custodians, the DTCC, and proxy firms.

It’ll take time before public markets are fully onchain but this is one of the hybrid advancements that will help move towards that and it will contribute by showing investors what collateral mobility enables and showing issuers savings and further alignment with their investors. Just like they did with the HELOCs and Democratized Prime, Figure is doing it for themselves first to prove the model which they’ll likely use to attract new issuers to do the same on their rails.

4. Trump Organization Announces Maldives Resort as First Tokenized Project

They’ve been teasing it for a while and now the Trumps are finally sharing what their first tokenized asset will be and it's their new Trump International Hotel Maldives. Is it another equity offering in it? Will there be perks tied to the resort like the St. Regis in Aspen? Not quite. It’s actually focused on the development phase of the resort, offering investors exposure to the appreciation that comes with it. Partnering with Dar Global, this offering allows the Trumps to expand beyond their USD1 stablecoin with World Liberty Financial while giving them an alternative source of financing (smaller retail or accredited investors) to what traditional real estate developers are accustomed to (institutional and high net worth individuals). Will the offering settle in USD1? What tokenization platform will they use (if not World Liberty)? We’ll keep an eye out for more details.

5. Obex Raises $37M for Stablecoin Incubator and Deploy $2.5B from Sky

Stablecoins are all the rage this year so naturally an incubator for stablecoins emerging is no surprise, but the amount it’s raised and is deploying might be! Last week Obex announced support from Sky, LayerZero, and Framework Ventures to identify the next wave of stablecoin innovators and help them immediately scale into one of the largest stablecoin ecosystems around, Sky (formerly Maker DAO). Incubators, accelerators, launchpads, grant programs - call them what you like, they’re proven ways to attract builders and seed ideas to drive adoption and utility for blockchain networks and specific applications such as, in this case, stablecoins and beyond. More proof we’re going to see more innovation and startup activity next year and more new stablecoins (and yieldcoins!) with it.

This is not financial advice.

Notable Market Headlines

11/21 - DekaBank, StanChart backed tokenization firm SWIAT becomes crypto registrar

11/21 - Hang Feng Technology Innovation and Animoca Brands Announce MOU for Strategic Partnership

11/20 - Saudi Arabia executes first tokenization as part of national real estate infra

11/20 - OFA Group Advances Development of Hearth RWA Tokenization Platform, Targeting Late 2025 Launch

11/20 - Dinari Integrates LayerZero to Offer Cross-Chain Access to Tokenized U.S. Equities

11/20 - Securitize Leverages Plume to Expand Global Real-World Asset Reach

11/19 - Societe Generale Breaks Ground with First US Blockchain-Based Bond - Banking Exchange

11/19 - WhiteBIT partners with Saudi Arabia to Advance the Kingdom's Blockchain and Tokenization Agenda

11/19 - Ondo wins Liechtenstein approval to offer tokenized stocks in Europe

11/19 - Netcapital Partners to Integrate Primary Issuance and Blockchain-Native Secondary Trading

11/18 - REtokens Launches RegCF

11/18 - tZERO Launches Crypto and Stablecoin Funding, Expanding Multi-Asset Access for Investors

11/18 - XTM Signs Letter of Intent with AGORACOM RWA DBX for Preferred Share Tokenization of U.S. Subsidiary

11/18 - Diginex Partners with EVIDENT Group to Enhance ESG Data Integration for Tokenized Assets

11/18 - Obex Raises $37M to Launch 'Y Combinator' for Real-World Asset Stablecoins With Sky's $2.5B Backing

11/17 - Datavault AI (NASDAQ: DVLT) Enters $8M Tokenization Agreement With Triton Geothermal

11/17 - CV5 Capital Partners with Enzyme to Deliver Institutional-Grade Tokenized Fund Solutions

Institutional Activity

RWA Foundation & WALLY DAO Updates

The RWA Foundation introduced the RWA Pod as “A permissionless way for anyone to support RWAs using crypto with multiple RWA project tokens as yield.”

In partnership with PERQ, the RWA Pod allows you to deposit ETH, USDC, ARB, and S/ Sonic. Participants will receive tokens on multiple blockchain protocols related to RWA projects that the RWA Foundation has qualified and selected as Founding Members.

What’s the update this week? Hear directly from your RWA Pod host, Ray Buckton!

Two of the tokens in the POD rewards are Brickken’s BKN and DRVN’s BSTR. Want to learn more about them? Check out interviews with their founders now available on X and on YouTube, go ahead and check them out 👇!

STM.co Data

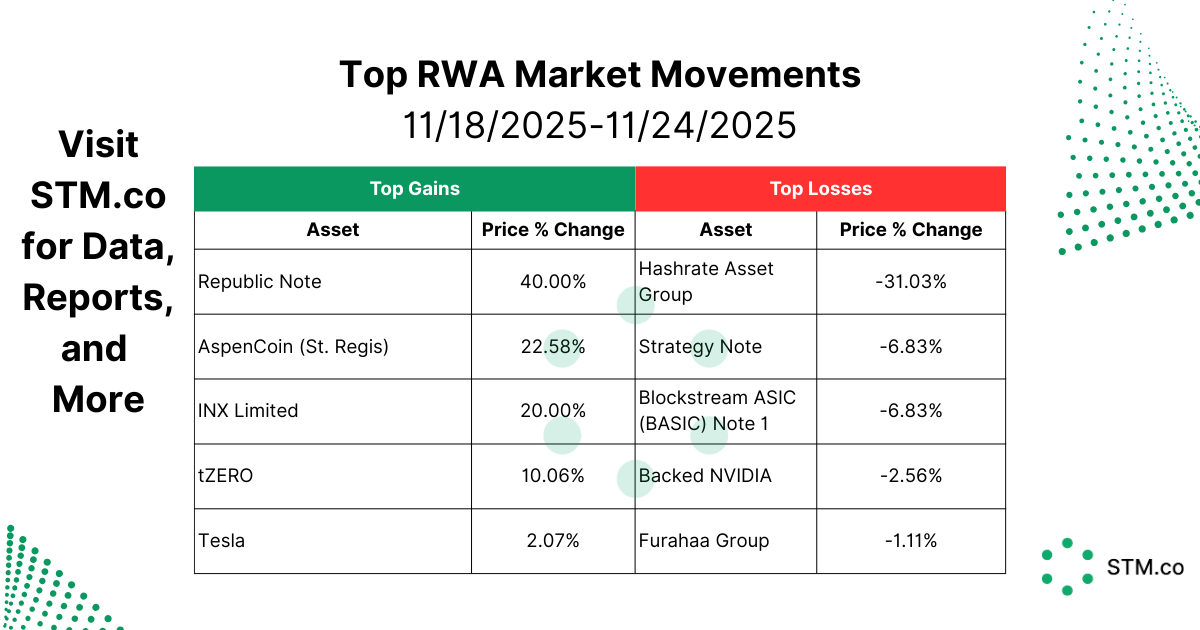

Given the crypto market going down it’s no surprise that investors are pulling away from bitcoin-associated investments like the top 3 losses, all concentrated on bitcoin mining in one way or another. The same goes for NVIDIA and the AI space starting to get cold feet from investors with fears of an AI bubble. In public markets NVIDIA experienced a bump after earnings exceeded expectations, however, shortly after AI stocks were red on traders’ heat maps. Looking at gains, bullishness around tokenization is evident with tZERO and INX going up and Republic Note saw a big 40% rally this past week likely thanks to their Q2 Portfolio Report showing an increase in portfolio companies.

This is not financial advice.

Think Like Herwig

Hello readers,

Happy (early) Thanksgiving to all, especially to you our loyal readers and supporters. A shout out to those who have been in this space for almost a decade or longer but specifically its amazing to think the concept was formed starting with stablecoins in 2014 and security tokens in 2017. The 10 year anniversary is always something special even if we can’t agree on when exactly, we all know it’s not an overnight success.

Now that tokenization has reached legitimacy and acceptance, we’re going to continue to see a wave of innovation enter the market which should be an extremely exciting prospect for everyone as it will only improve the interest and investment in the whole sector. As we prepare for next year we are also preparing for TokenizeThis 2026.

Please reach out to Jason or myself if you’re interested in being a partner, we’re already having conversations with new firms and accepting repeat sponsors as priority.

Happy tokenizing,

Herwig “Happy” Konings

CEO, Security Token Group

💦 What Else is Drippin’

Security Token Show Ends with 300 Episodes!

Check out the latest and final episode of the Security Token Show as well as the full catalog on Youtube, Spotify, Apple Podcasts & Google Podcasts.

Reports

RWA Tokenization: Key Trends and 2025 Market Outlook

Check out a report we contributed to: RWA Tokenization: Key Trends and 2025 Market Outlook. Led by Brickken, this report brings multiple parties together in diving into tokenization, with STM.co supporting with both data and some of the written sections.

What’s Inside?

✅ A Breakdown of Tokenization and Related Benefits

✅ Key advantages for issuers, investors, and institutions

✅ How the market is evolving and trends shaping adoption in 2025

✅ What’s next? Expert insights on regulation, DeFi integration, institutional involvement, and market growth

STM’s RWA Market Prediction for 2030

STM.co is proud to release a thorough report on our prediction on the tokenized real world asset market growth. This report explores the variety of opportunities within each asset class to capture value on-chain.

Tokenization can be applied to just about any object and asset type. Art, carbon credits, life insurance, and other sub $5 trillion asset classes weren’t even considered in estimates.

In order for STM to derive its 2030 market predictions, the following asset classes were evaluated: currency, M2/M3, real estate, commodities, public equities, private companies and funds, bonds, credit and lending markets.

This is not financial or investment advice.

Helpful Resources

$30 Trillion by 2030 - STM

Tokenizing an Asset in 3 Easy Steps - Security Token Show

Tokenization for Institutions - What You Need to Know - STM, Arca (YouTube)

We hope you enjoyed this week's What’s Drippin’ email - if you have any feedback on either what you liked or what you’d like to see, please reply to this email with it.

Everything in this newsletter is for informational and entertainment purposes only. Nothing in this report should be taken as financial advice or as an inducement to purchase or sell any security. Nothing in this newsletter should be used as legal advice. Always do your own research before making any decisions regarding financial transactions of securities.